wyoming tax rate lookup

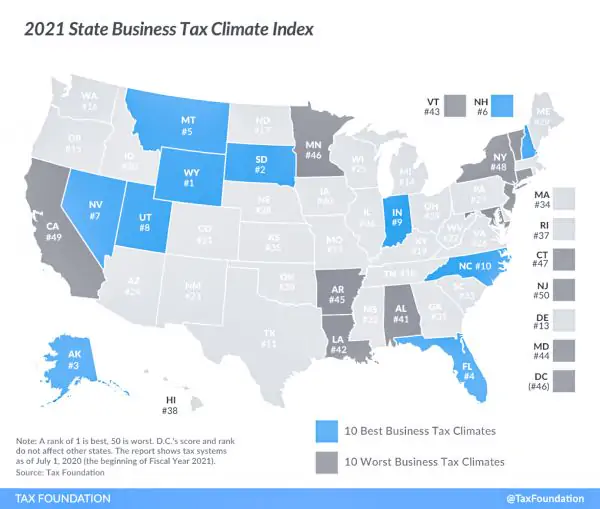

The Wyoming sales tax rate is currently. Wyomings tax system ranks.

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

ZIP--ZIP code is required but the 4 is optional.

. The minimum combined 2022 sales tax rate for Cheyenne Wyoming is 6. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wyoming local counties cities and special taxation. Skip to main content.

With local taxes the total sales tax rate is between 4000 and 6000. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6. Depending on local municipalities the total tax rate can be as high as 6.

ZIP--ZIP code is required but the 4 is optional. Our state ranking and income tax figures are based on a family of four married parents with two children earning the national median household income of 50000 per year. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

Wyoming Property Taxes Go To Different State 105800 Avg. Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and. The average property tax rate is only 057 making Wyoming the lowest property tax taker.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. To access the tax information system please click here. Use this search tool to look up sales tax rates for any location in Washington.

This is the total of state county and city sales tax rates. Have a question or. The page will open in a new window.

31 rows Wyoming WY Sales Tax Rates by City The state sales tax rate in Wyoming is 4000. Prescription drugs and groceries. The Wyoming sales tax rate is currently 4.

Click the link below to access the Tax Bill Lookup. The mission of the property tax division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property. Find your Wyoming combined state and local.

Please use the following credentials to enter the system. Use this search tool to look up sales tax rates for any location in Washington. The base state sales tax rate in Wyoming is 4.

On the left hand side of the screen click on Tax Information Search Enter your search criteria either last name address or parcel number. The County sales tax rate is. Sales Use Tax Rate Charts.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. 058 of home value Tax amount varies by county The median property tax in Wyoming is 105800 per year for a home worth. See the publications section for more information.

Wyoming ranks in 10th position in the USA for taking the lowest property tax. Wyoming sales tax details The Wyoming WY state sales tax rate is currently 4. The minimum combined 2022 sales tax rate for Bill Wyoming is.

This is the total of state county and city sales tax rates. State wide sales tax is 4. Back to Excise Tax Division.

Wyo Property Tax Rates Rank Right At The Bottom

Buy Sales Use Tax Online Lookup Online Zip2tax Ll

Wyoming Who Pays 6th Edition Itep

2017 Tables Fill Out Sign Online Dochub

Wyoming Construction Or Mechanics Lien Package Corporation Or Llc Wyoming Fill Out Sign Online Dochub

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Camden Wyoming Delaware Sales Tax Rate Sales Taxes By City October 2022

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Wyoming Sales Tax Calculator And Local Rates 2021 Wise

Wyoming Labor Market Information

International Fuel Tax Agreement Ifta

Wyoming Voters To Decide On Slashing Property Taxes Enacting Income Tax Mlive Com

Lccc Study Wyo Residents Can Afford Higher Taxes Casper Wy Oil City News